Welcome back to Dan’s Money Help Blog.

Our Mission is to help you be smart with your money.

Check us out at https://www.BudgetingEssentials.com

Today, I am going to share with you how just recently

I saved over $500 on auto repairs.

Spoiler alert: Yes, it took some time and effort,

but do you like to be reimbursed for your time and effort?

Do your homework

I took my 10-year-old pickup into the shop for repairs.

I was told when I dropped the truck off that it would take up to a week

to get my spot on the infamous diagnostic machine

that will tell them what is wrong with my vehicle.

Next, came the estimate.

The service guy called me to let me know that there were two options.

Option number one was the items that Must-Get-Fixed.

Option number two added the repairs that Should-Be-Done.

Either way, the costs were quite significant.

The service guy told me to call him back to

let him know which option I wanted to go with.

On the home front, we discussed the value of our truck,

versus the cost of getting a newer used vehicle,

or a brand-new ride.

We quickly eliminated the brand-new ride -

due to cost and insurance rates.

To us, it seemed more cost effective to

repair our current truck.

Since we chose to keep the pickup,

we decided to get everything fixed.

So, I called the service guy back to let him know.

In the verbal conversation,

he told me that since we were getting everything fixed,

he was going to provide two of the services listed for no charge.

The charge for these two services came to just over $500.

All further conversations between me and the service repair guy were via text.

Next, came the problems........

Parts ordered not coming in timely.

Technician was working slow due to physical issues in his back.

Our technician only had two bays.

The rust on the truck slowed the process down

because the old parts (still on the truck) needed

to be sprayed in order to get them to come off.

Over the next 5 weeks,

we were promised multiple times,

that the job would be done within a couple more days.

Long story short, that turned into 5 weeks.

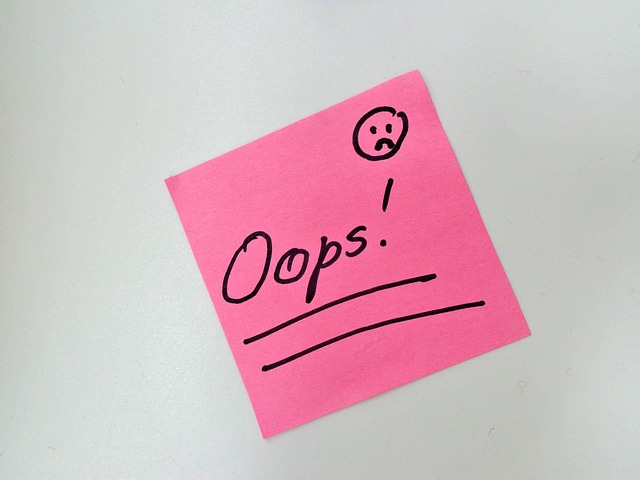

When we got the final bill,

those two “no-charge” services showed up on the final bill.

Although this may not be your story today,

I want to give you a heads up in case

this ever becomes your story.

It is always easier to learn from the life events

that others have experienced.

When I saw the bill,

I immediately recognized the overcharge.

So, in stead of getting angry, I took the time to do my homework:

I took a screenshot of each text between myself

and the service guy,

and sent them to my email.

There was a total of 33 texts over the 5 weeks.

Then I copied the text pictures into a

Word doc on my desktop computer.

Next, I did a PDF print of this Word doc,

so I could send these text copies as an attachment on

the email I would send to the service guy.

Finally, I also attached a copy of their repair bill

with those two no-charge items highlighted.

The email was worded carefully.

I said that I wanted them to reduce my bill

by the dollar amount of the two services that the service guy told me

he would do for no charge.

I went on to explain in gentle language,

that the repair shop had my vehicle for 5 weeks.

I mentioned that they told me several times

that the vehicle was going to be ready

the next day (which could be viewed in the copies of the texts).

I mentioned nicely,

that this event had been a great inconvenience

for my family since we had to share vehicles

while they were working on my truck.

I asked them to please send me a copy

of the reduced updated bill

when it was ready so we can come get our truck.

The result?

The service manager honored

what the service guy had told me over the phone.

He authorized the removal of the two verbal

no-charge services from the revised final bill.

Although I did not expect to hear from the service guy

until the next business day, he called me back the same evening.

He was apologetic for the time it took to repair my truck

and we both agreed that in the future,

all discussions of services would be done via text. That way it is in writing.

Here are the some of the things to remember

when a service does not go as expected:

Do all communications over text, so everything is in writing.

Always speak respectfully with all parties

you are dealing with, no matter how angry you may feel.

Deny those feelings for a good result.

Be understanding of the pain of others.

Be kind, and do your homework – it can pay off handsomely.

Pro Tip:

If the service shop or dealership offers a 10% discount

on their services, find out immediately what

the cap on that offer is.

For instance, they may cap the discount at $150.

If that is the case, it could be a good financial decision

to get a portion of the work you want done over several appointments.

This way, you could get that discount on each visit.

Choosing this option may also save time

due to less parts ordered on each repair visit.

Go ahead. Persevere, and remember that

your how you come across to others,

may well be tied to the result you get.

Remember the Goal:

Be kind and do your homework to obtain the best results!

Truth in Our Advertising:

Currently, the only revenue Dan the Budget Man

and Budgeting Essentials receives comes from the products we sell.

If you would like to purchase a product, we appreciate it so much!

The first one is free. (Free Debt relief workshop)

- The second one is a paid product so you can do your bookkeeping quickly and efficiently without a subscription. (SST)

- The third one is a paid product that takes you into a deep-dive of how to take control of your money and pay off your bills. (Debt Relief & Budgeting Program)

Economic times got you down? Free Help Here:

Try our free and simple Debt Relief Workshop (<- Click and go)

Tired of paying every month to get your books done quickly?

It’s called SST – short for

“Spend Smart Tool” (<- Click to learn more)

Best News = Not a Subscription model. One price. One time. Lifetime access.

Debt Relief & Budgeting Program

Click the link above to learn more.

What do you want money help with?

Describe in one sentence what you need money help with.

Want more money help INSPIRATION?

See You next time!

Copyright

© © Budgeting Essentials © BudgetET © Dan the Budget Man © B.E. Blogs